How to analyze the economic indicators for investment by cryptocurrency

The world of investments in cryptocurrency becomes popular, many traders and investors who want to capitalize on rapid growth and potential yields of these digital assets. However, before making investment decisions, it is essential to understand solidly how economic indicators can influence price movements and the direction of cryptocurrencies.

In this article, we will explore the importance of analyzing economic indicators for cryptocurrency investments, including the types of indicators to look for, their strengths and weaknesses and, once they are taken into account for traders and investors.

Why analyze economic indicators?

Economic indicators are widely considered as the most important factors that influence cryptocurrency prices. By analyzing these indicators, you can get valuable information on the economic trends, feelings and basic economic expectations of market participants. Here are just a few reasons why analyzing economic indicators is crucial:

* Predicing price movements : Economic indicators can predict future price movements by identifying the models and trends of economic data.

* Identification trends : Analysis of economic indicators can help you identify the trends and models that can affect the price of cryptocurrencies.

* Improving trading decisions : Analyzing economic indicators, you can make more informed trading decisions, taking into account various market conditions.

Types of economic indicators to search

When analyzing economic indicators for cryptocurrency investments, it is essential to consider the following types:

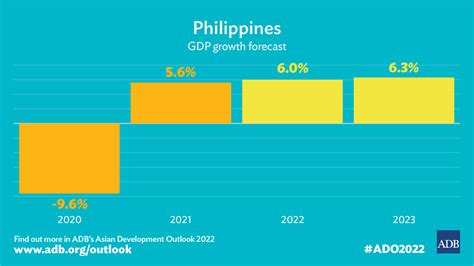

- GDP growth rate : A strong GDP growth rate is often a positive indicator, as it suggests an expanding economy.

- Inflation rate : Low inflation rates are generally more favorable than high inflation rates, which can erode purchasing power and affect cryptocurrency prices.

- Interest rate : Interest rates changes can affect the demand for cryptocurrencies and movements of their prices.

- Gross domestic product (GDP) : A strong GDP growth rate is often a positive indicator of economic health.

- Unemployment rate : Low unemployment rates are generally more favorable than high unemployment rates, which can affect cryptocurrency prices.

The strengths and weaknesses of economic indicators

While economic indicators can be valuable tools to invest in cryptocurrencies, they also have limitations:

* Data quality problems

: The quality of economic data can vary significantly between countries and regions, affecting the accuracy of the indicators.

* Macroeconomic data dependence : A pass with microeconomic factors can lead to incorrect conclusions about market behavior.

* Lack of prospects in real time : Economic indicators may not provide real -time information on market feelings or price movements.

Keys -Keys for Traders and Investors

To get the most analysis of economic indicators, keep in mind these key aspects:

- Use more indicators

: Combining several economic indicators can help identify more accurate models and trends.

- Consider Macro vs. Microeconomic factors : understanding of macroeconomic and microeconomic factors is crucial for making informed investment decisions.

- Stay up to date with market conditions : Continuously monitor market conditions, including economic data communications, to stay in front of the curve.

By incorporating economic indicators into your investment strategy, you can increase the accuracy and effectiveness of your transactions.

In conclusion, the analysis of economic indicators is an essential aspect of cryptocurrency investments.